Current assets include inventory, while fixed assets include such items as buildings and equipment.

#Total asset turnover high or low professional#

Sales are the unique transactions that occur in professional selling or during marketing initiatives.

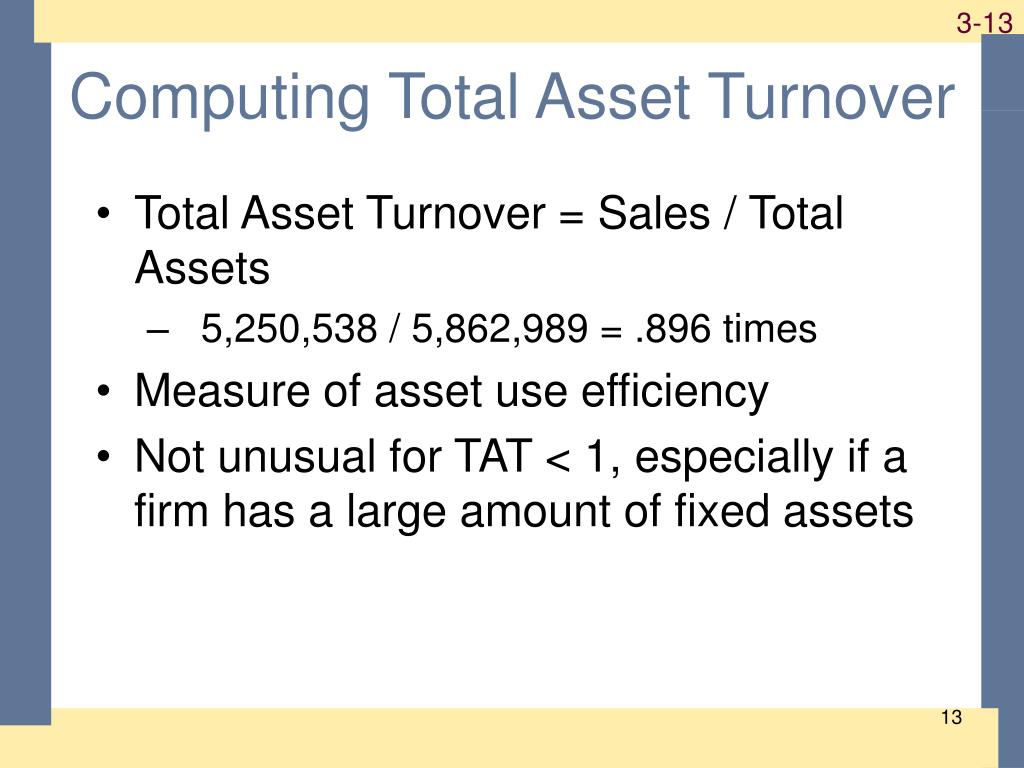

"Sales" is the value of "Net Sales" or "Sales" from the company's income statement".Total assets turnover = Net sales revenue / Average total assets Companies in the retail industry tend to have a very high turnover ratio due mainly to cut-throat and competitive pricing. As mentioned previously, the higher the asset turnover ratio the better a company is utilizing its assets to generate revenue.Asset turnover measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company.Ĭompanies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover. These ratios suggest that Company B is more efficiently using its assets to generate revenue as its asset turnover ratio is greater than Company A’s asset turnover ratio. Here’s how the values will appear in the formula:Ĭompany B’s Asset Turnover Ratio = $7 million / $1.5 million = 4.67 Company B’s average total assets at the end of the year were $1.5 million. The next company in the example is Company B with total revenue of $7 million at the end of the fiscal year. Here’s how the formula looks when you enter the above values into the asset turnover ratio calculator:Ĭompany A’s Asset Turnover Ratio = $6.5 million / $3.75 million = 1.73 The average of the total assets are $3.75 million ( / 2). The company’s total assets at the beginning of the year were $3 million and $1.5 million at the end of the fiscal year.

Security Reduce your liability when handling customer card data.įor this example, Company A has a total net sales of $6.5 million at the end of its fiscal year. Total asset turnover Total annual sales / ( (Total assets at start of year + Total assets at end of year) / 2) This formula therefore shows how high the asset turnover is in a business year.Business Types Find solutions that fit the workflow of your business and industry.

Features (All-Inclusive) 20+ features that simplify the payment collection process.Integration Marketplace → Accept payments inside 100+ accounting, ERP, CRM, and eCommerce tools.Accept Payments Accept credit, debit and eCheck payments across multiple channels.

0 kommentar(er)

0 kommentar(er)